Business Insurance in and around Warren

One of Warren’s top choices for small business insurance.

This small business insurance is not risky

Coverage With State Farm Can Help Your Small Business.

When experiencing the challenges of small business ownership, let State Farm do what they do well and help provide great insurance for your business. Your policy can include options such as business continuity plans, errors and omissions liability, and worker's compensation for your employees.

One of Warren’s top choices for small business insurance.

This small business insurance is not risky

Small Business Insurance You Can Count On

Whether you own an arts and crafts store, an antique store or a barber shop, State Farm is here to help. Aside from remarkable service all around, you can customize a policy to fit your business's specific needs. It's no wonder other business owners choose State Farm for their business insurance.

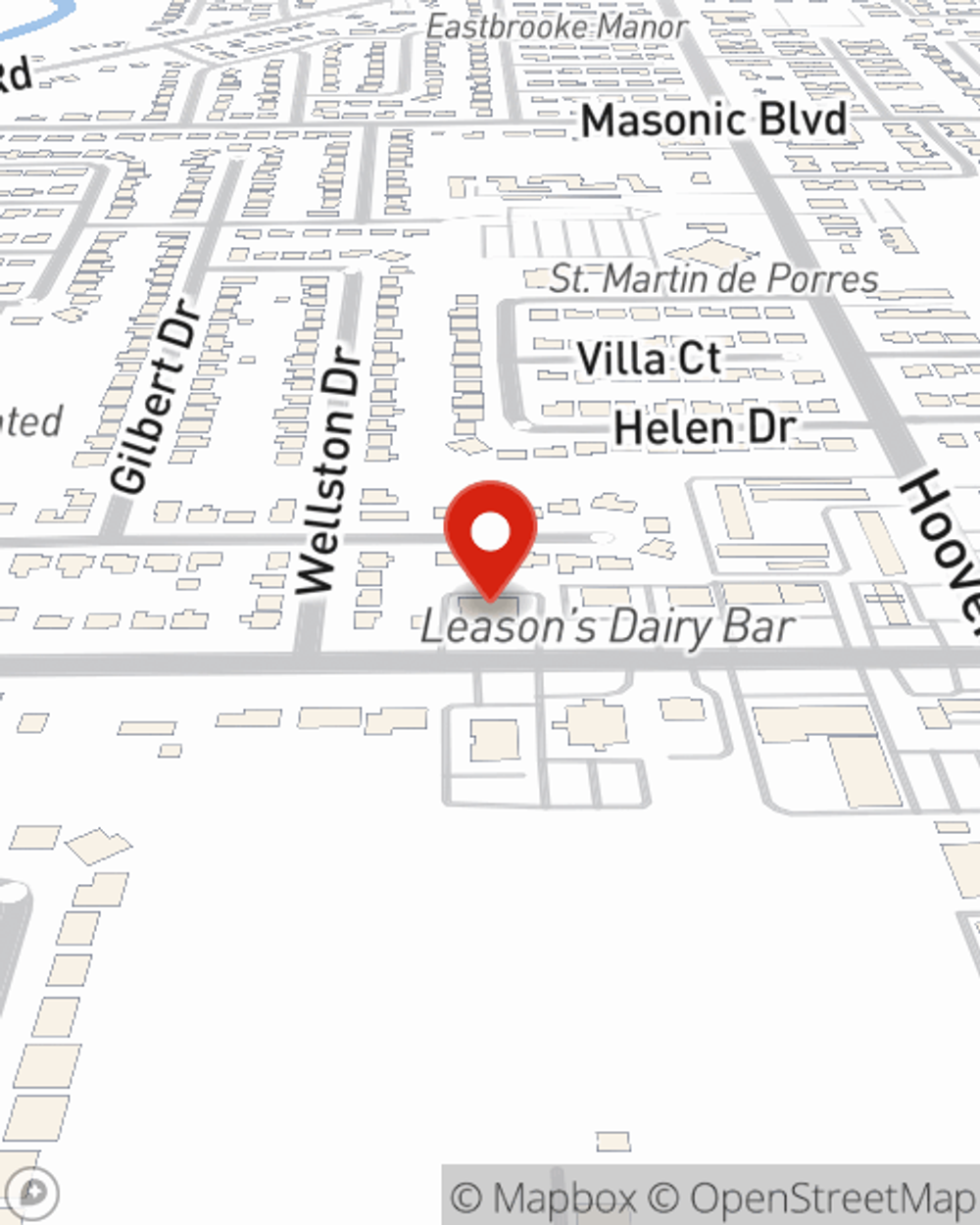

Get right down to business by visiting agent Steve Donovan's team to talk through your options.

Simple Insights®

Trailer insurance coverage

Trailer insurance coverage

Consider trailer insurance coverage to help protect the value of your trailer.

Ways to help set financial goals

Ways to help set financial goals

As a business owner, your financial goals should be split into two worlds: one set for your business and another for your personal life.

Steve Donovan

State Farm® Insurance AgentSimple Insights®

Trailer insurance coverage

Trailer insurance coverage

Consider trailer insurance coverage to help protect the value of your trailer.

Ways to help set financial goals

Ways to help set financial goals

As a business owner, your financial goals should be split into two worlds: one set for your business and another for your personal life.